Houzz Study Finds that Widespread Industry Confidence Continues

July 20, 2016

Houzz Inc. today released the Q2 2016 Houzz Renovation Barometer, which tracks confidence in the home renovation market among industry professionals. The Q2 2016 Barometer reflected widespread quarter-over-quarter confidence for all industry sectors including architects, designers, general contractors/remodelers, design-build, specialty building/renovation and specialty landscape/outdoor, with readings of 63* or higher. Outlook for Q3 continues to be positive for all sectors.

Year-over-year increases in business activity across all sectors tend to be driven by older homeowners. Half or more firms across all sectors report an increase in activity of homeowners ages 35-54 so far in 2016, relative to the same period in 2015 (46-58 percent). Projects from Baby Boomers have increased for many as well (36-51 percent). Unsurprisingly, projects from Millennials are increasing at a slower rate, with 21-28 percent of firms across all sectors reporting growth in projects from this age group.

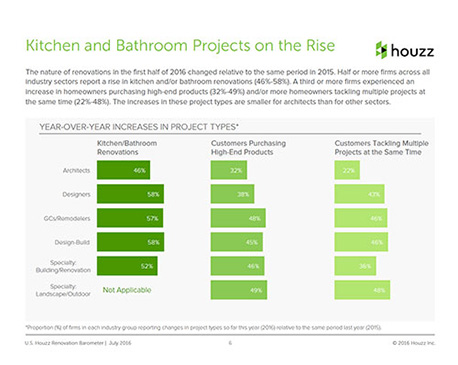

Looking at other factors driving increased business activity, a third or more firms across all sectors report that more clients are purchasing high-end products in 2016 relative to the same time in 2015 (32-49 percent), and a quarter or more of firms are seeing more clients are tackling multiple projects at the same time (22-48 percent). In addition, half or more firms report an increase in year-over-year kitchen and bathroom renovations (46-58 percent).

A third or more firms across all industry sectors report increases in smart home technology installations and aging-related upgrades (32-45 percent and 30-45 percent, respectively). Many firms also experienced growth in energy efficiency upgrades and eco-friendly/green projects (27-41 percent and 19-46 percent, respectively).

“Barometer readings over the past six quarters have shown consistent confidence in the home renovation industry, despite slight softening in some sectors,” said Nino Sitchinava, principal economist at Houzz. “The increase in Baby Boomer and Gen Xer activity, as well as an uptick in kitchen and bath activity, is consistent with our recent insights from other studies of homeowners and are a great sign of the vitality of our industry.”

Additional findings from the Q2 2016 Houzz Barometer include:

• Widening gap in confidence across sectors:

• The Q2 2016 scores for architects, designers, and design-build companies are five to seven percent lower than the Q1 2016 scores, while scores of other sectors increased or stayed the same. Further widening in the confidence gap between architects and designers

• relative to other sectors (63-66 vs. 71-78) indicates that quarter-over-quarter market gains are not equally widespread across sectors.

• Year-over-year gains persists, but with some market softening:

• The Barometer posted high year-over-year readings of 66-77 in Q2 2016, albeit somewhat below those in Q2 2015 for four of the five sectors. Scores for

• architects, designers, and design-build companies have declined four quarters in a row from a high of 75-80 in Q2 2015 to 66-73 in Q2 2016.

• Regional patterns consistent with national:

• Regional scores indicate widespread optimism that new business activity is continuing to improve quarter-over-quarter and

• year-over-year.

More News

April 18, 2024 | Business, People

Excelling at Kitchen Design When You Don’t Like to Cook

April 18, 2024 | Awards & Events

KCMA Design Awards Announces Winners

April 17, 2024 | People

WAC Lighting Promotes Becky Li to President

April 16, 2024 | Awards & Events

Kips Bay Boys & Girls Club Honors Ellie Cullman, Cosentino

April 15, 2024 | Trends & Inspirations

Houzz: Renovation Slows, but Design Pros Optimistic

April 2, 2024 | Sponsored

Whirlpool Corp. Brings Purposeful Innovation Home